AI Agent Narrative Rise: Can Hype Trigger Price Explosion?

Original Article Title: AI Agents: Does Price Action Follow Attention?

Original Article Author: S4mmyEth, Crypto Kol

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: This article discusses the growing prominence of AI agents and their increasingly important role in DeFi. It analyzes the mismatch between AI agent attention and market value, suggesting that "smart interaction" may better reflect market potential. The article also introduces new platforms such as injective and modenetwork, emphasizing the importance of innovation, market leadership, and cash flow for AI agent success.

Below is the original content (slightly reorganized for better readability):

The current cryptocurrency market is experiencing volatility while awaiting Bitcoin's breakthrough into the six-digit territory. During this time, attention has shifted to two key areas: MEME coins and artificial intelligence.

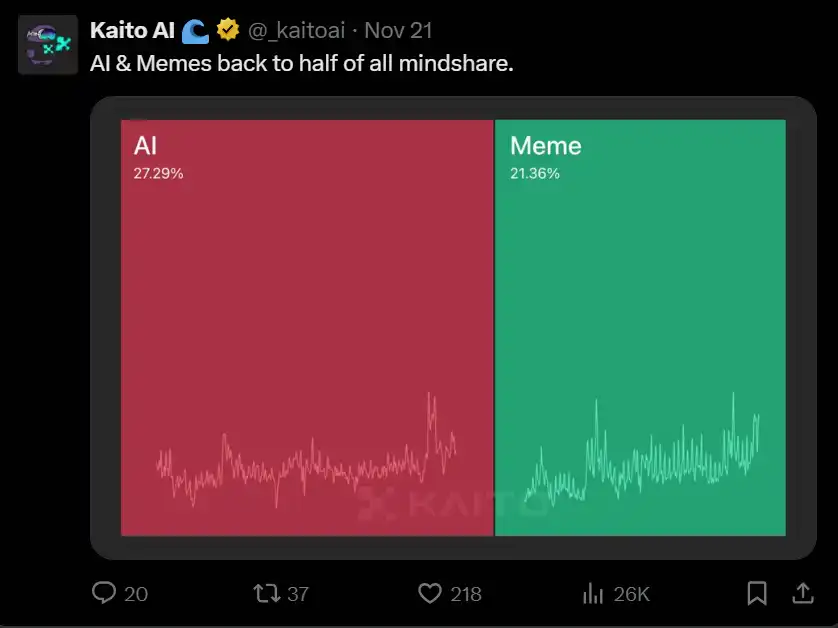

According to kaitoai's data, 48% of the attention on Crypto Twitter is focused on these two areas.

The article explores how these trends are shaping the cryptocurrency ecosystem, with a focus on the rise of AI agents and their evolving role in DeFi.

Table of Contents

1. The Rise of Web 4.0 and AI Integration

2. Evolution of AI Agents

3. Mindshare vs. Market Cap: AI Agent Performance Analysis

4. Case Study of ai16zdao: Breaking the Traditional Analytical Framework

5. Evaluating Key Metrics for AI Agents

6. Decentralized AI Dynamics: Other News and Developments

The Rise of Web 4.0 and AI Integration

Last week's discussion on Web 4.0 revealed the intersection of cryptocurrency and artificial intelligence, a topic that continues to garner widespread attention.

Binance's latest report highlights the tremendous potential of this emerging market, noting that DeFi integration and a collaborative community are key areas of growth.

While agency has long existed across industries, entering the crypto track has brought about a disruptive change. It has enabled true autonomy of AI agents by eliminating barriers of the traditional banking system.

This seamless integration has paved the way for exponential growth, as demonstrated by this continuously updated Crypto AI Agent and Protocol Tracker.

The Evolution of AI Agents

The field of AI agents is rapidly advancing at an unprecedented pace.

New developments, such as the cookiedotfun AI Agent Index, empower users to track participants in emerging markets.

The integration of decentralized technology has transformed AI agents from simple tools to autonomous entities capable of executing complex financial operations.

Key advancements include:

1. Greater autonomy achieved through blockchain integration.

2. Expansion of use cases within the DeFi ecosystem.

3. Seamless user experience driving accelerated adoption.

Mindshare vs. Market Cap: Analysis of AI Agent Performance

Is mindshare correlated with price trends?

Historically, funds often flow to areas of concentrated mindshare. However, in the AI agent field, the relationship between mindshare and market cap seems not to perfectly align.

Using November 24, 2024, as an example, the disparities between market cap and mindshare can be seen:

0xzerebro leads in mindshare but has only half the market cap of GOAT, despite its mindshare being 2.8 times higher.

dolos diary holds 60% of GOAT's mindshare but its market cap is only 20% of GOAT.

Starting with low initial mindshare, Aixbt agent saw a rapid surge in market cap within 12 hours despite not initially receiving attention.

While attention reflects market sentiment, it does not always directly translate into capital inflow. Instead, "Smart Interaction" (interaction from accounts with financial influence) may be more indicative of market potential.

A16z Case Study: Breaking the Traditional Analysis Framework

A16z's performance has surpassed the limits of traditional metrics such as Net Asset Value (NAV). Its price trades at a multiple far above NAV, attributed to an "AI Premium."

This premium reflects the potential value of its Large Language Model (LLM) performing above the market average.

The introduction of the elizawakesup framework has played a key role, with contributions collected through this framework directly adding value to A16z, driving its price well beyond traditional expectations.

This underscores the importance of the following factors:

Continual innovation from the development team.

Capturing significant attention.

Building mechanisms that can directly accrue value to the token.

Evaluating Key Metrics for AI Agents

To discover undervalued AI agents, consider the following:

Smart Interaction: Accounts labeled as "smart" may signal early capital deployment.

Domain-Specific Dominance: Agents excelling in a specific domain typically hold higher value.

Cash Flow Potential: Agents with actual financial returns are more likely to attract sustained investment.

For example, AiXBT demonstrated significant value by providing extensive data insights, leading to a 50% price increase.

Conversely, personality-driven agents often attract attention but may not necessarily result in corresponding financial impact.

Decentralized AI Dynamics: Other News and Developments

·injective Launches AI Agent Platform

·nvidia References Agent AI in Earnings Report, AI Coin Skyrockets

·After its latest funding round, xai reaches a $500 billion market cap

·vvaifudotfun raises $90 million in funding, launches new AI agent paired with a token

·modenetwork introduces AiFi—driving the convergence of AI agent infrastructure with an app store

·polytraderAI—utilizing the Polymarket API for analysis and trading

You may also like

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

Coinbase UK Executive Declares Tokenised Collateral a Mainstream Financial Force

Key Takeaways Tokenised collateral is transitioning from its initial experimental stages into becoming core infrastructure within financial markets.…

Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

Key Takeaways The cryptocurrency market witnesses volatility amid a technology-sector selloff, but opportunities still exist for keen investors.…

Why Is Crypto Down Today, February 6, 2026

Key Takeaways The global cryptocurrency market has seen an 8% decline in the last 24 hours, standing at…

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

Earn

Earn