Bitcoin V-Shaped Reversal, CME Gap Could Be the Biggest "Risk"

Original Article Title: "After Bitcoin's V-Shaped Reversal, Could the CME Gap Be the Biggest 'Hidden Danger'?"

Original Source: BitpushNews

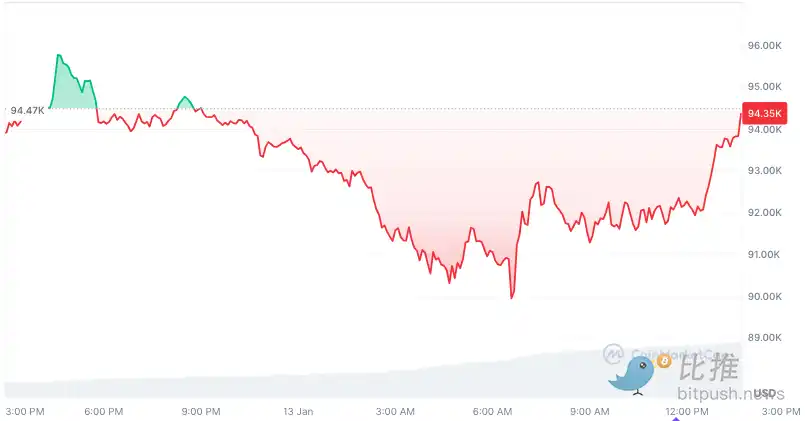

Over the past 24 hours, Bitcoin has staged a V-shaped reversal drama, hitting a low of $90,000, an eight-week low, and bouncing back above $94,000 after the U.S. stock market close, with the market's longs and shorts in a tense situation. Bitcoin's price has dropped over 7% in the past week. Although its market cap continues to hover around $1.864 trillion, its dominance has slightly decreased to 54.2%.

Macroeconomic Factors Lead to Temporary Market Cooling

Experts believe that the pullback that began last week is attributed to optimistic U.S. economic data, including better-than-expected initial jobless claims and labor participation rate. This data has heightened concerns that interest rates may remain high for a longer period than expected.

Chris Chung, CEO and Founder of Titan, stated: "The market seems very concerned that there won't be any more rate cuts in 2025, especially given the incredibly strong jobs report released on Friday. But we also saw a big rally in December, so it's not uncommon for the market to readjust after such a large rally."

He pointed out that with U.S. President-elect Donald Trump set to be inaugurated next week, there is still "further downside risk" in the cryptocurrency market.

Chris Chung said: "Everyone expects Trump to announce regulatory support for cryptocurrency on day one, but he may start with more pressing issues given the Republican control of the House and Senate, along with macro concerns and upcoming token unlocks, this market adjustment may continue into February or even March."

James Butterfill, Head of Research at CoinShares, stated in his fund report: "The honeymoon period after the U.S. election is over, and macroeconomic data once again becomes a key driver of asset prices."

Derivatives Data Shows Sentiment Ranges from Mildly Bullish to Neutral

It is worth noting that the reaction in the Bitcoin derivatives market has been relatively mild.

Firstly, the futures premium is high, as Bitcoin futures contracts typically trade at a premium to the spot market, reflecting market optimism about future prices. Data shows that the current annualized premium rate is at 11%, above the 5%-10% neutral range, indicating that market participants overall remain optimistic.

Another indicator is the perpetual contract funding rate (usually reflecting market sentiment). Although on January 13, due to a large number of short positions entering the market, the funding rate briefly turned negative, accompanied by $1.07 billion in long liquidations. However, it quickly rebounded to around 0.5% monthly rate, showing that the market did not exhibit sustained bearish sentiment.

CME Gap Pressure, Will It Be Filled?

Analysts say there is a gap between $88,500 and $77,500 on the CME chart. When there is a difference in the Bitcoin futures price between the close of one trading day and the open of the next trading day, a CME gap occurs, which usually causes Bitcoin to tend to return to a certain level. If Bitcoin faces a downward correction, this gap represents a potential bearish target.

Analysts believe that given Bitcoin's current price of around $94,000, a drop from this level could lead to a significant pullback, potentially resulting in a decline of up to 18% to fill this CME gap.

In addition to the CME gap, veteran market analysts like Peter Brandt also point out a potential bearish signal on the Bitcoin daily chart. Brandt suggests that a head and shoulders pattern could form, which may indicate that the Bitcoin price could fall to $73,000. However, Brandt also warns against relying too heavily on this chart as BTC's high volatility often leads to changes in chart patterns.

Therefore, Bitcoin's current trend is influenced by multiple complex factors. While the derivatives market remains relatively calm, the presence of the CME futures market gap, a potential head and shoulders pattern, and key support levels increase the risk of a price downturn. If Bitcoin continues to face pressure, the market will closely monitor whether it will fill the CME gap, which could trigger significant market volatility.

You may also like

BankrCoin Achieves New Milestones as YZi Labs and ETH Investors Make Significant Moves

Key Takeaways BankrCoin (BNKR) hit a new all-time high with significant market activity. YZi Labs executed a major…

Bitcoin Tests $75K Amid Market Predictions

Key Takeaways Bitcoin shows a 47% chance to test the $75,000 mark this February, contrasting with a potential…

MrBeast Acquires Step to Enhance Financial Offerings for Youth

Key Takeaways YouTube star MrBeast has acquired the financial services platform Step through Beast Industries. The acquisition aims…

Polymarket Predicts Bitcoin Uptrend as MrBeast Ventures into Fintech

Key Takeaways Bitcoin’s Potential Surge: Polymarket denotes a fluctuating probability of Bitcoin achieving $75,000 in February, reflecting volatile…

MrBeast Enters Financial Services with Step Acquisition

Key Takeaways Binance announced an Alpha Airdrop event, highlighting the growing trend of gamified airdrops. Bitcoin prediction markets…

Analysts Predict Bitcoin May Fall to $55K as Support Levels Threaten

Key Takeaways Analysts suggest a potential drop of Bitcoin to $55K if current support levels are breached. Galaxy…

Analysts Predict Bitcoin May Drop to $55K Amid Support Challenges

Key Takeaways Experts caution that Bitcoin could fall to $55,000 if current support levels are breached. The market…

Bitcoin May Decline to $55K: Analysts Warn

Key Takeaways Analysts project Bitcoin could drop to $55,000 if key support levels fail. Technical analysts forecast that…

YZI Labs Transfers Massive ID Tokens to Binance as BNKR Hits New High

Key Takeaways BNKR, a digital currency, has achieved its highest-priced milestone of $0.295 CAD as of January 26,…

MrBeast Acquires Step, Expanding Influence in Teen Finance Market

Key Takeaways MrBeast has acquired the financial services app Step, which caters specifically to Gen Z users. Step…

Analysts Predict Bitcoin’s Critical Support Level May Trigger Decline

Key Takeaways Experts indicate a crucial moment for Bitcoin, with potential price drop to $55,000 if support fails.…

Michael Saylor Faces Bitcoin Valuation Challenges: Impact on the Crypto Market

Key Takeaways Michael Saylor’s Bitcoin investment is currently valued at $55 billion, but recent market trends have seen…

MrBeast Acquires Step FinTech App in Strategic Move

Key Takeaways MrBeast’s company, Beast Industries, has announced the acquisition of Step, a fintech app focused on Gen…

Bitcoin’s Potential Surge Sparks Debate Among Investors

Key Takeaways The probability that Bitcoin will reach $75,000 in February fluctuates as predicted by Polymarket. Bitcoin recently…

Analysts Predict Bitcoin’s Potential Plunge to $55K

Key Takeaways Analysts warn of a possible drop to $55K if Bitcoin’s current support breaks. 10X Research and…

Bitcoin’s Critical Threshold: The Significance of $55,000 USD

Key Takeaways Bitcoin’s value is set to rise from $55,000 to $99,000 if it maintains a growth cycle…

Analysts Predict Bitcoin Drop to $55K as Support Wavers

Key Takeaways Analysts caution that Bitcoin’s price could plummet to $55K if current support levels fail. Galaxy Digital’s…

MrBeast Acquires Step, Expanding Fintech Influence

Key Takeaways MrBeast’s company, Beast Industries, has acquired the Gen Z-focused fintech app Step, which targets teens with…

BankrCoin Achieves New Milestones as YZi Labs and ETH Investors Make Significant Moves

Key Takeaways BankrCoin (BNKR) hit a new all-time high with significant market activity. YZi Labs executed a major…

Bitcoin Tests $75K Amid Market Predictions

Key Takeaways Bitcoin shows a 47% chance to test the $75,000 mark this February, contrasting with a potential…

MrBeast Acquires Step to Enhance Financial Offerings for Youth

Key Takeaways YouTube star MrBeast has acquired the financial services platform Step through Beast Industries. The acquisition aims…

Polymarket Predicts Bitcoin Uptrend as MrBeast Ventures into Fintech

Key Takeaways Bitcoin’s Potential Surge: Polymarket denotes a fluctuating probability of Bitcoin achieving $75,000 in February, reflecting volatile…

MrBeast Enters Financial Services with Step Acquisition

Key Takeaways Binance announced an Alpha Airdrop event, highlighting the growing trend of gamified airdrops. Bitcoin prediction markets…

Analysts Predict Bitcoin May Fall to $55K as Support Levels Threaten

Key Takeaways Analysts suggest a potential drop of Bitcoin to $55K if current support levels are breached. Galaxy…