Ethereal, the first airdrop project in the Ethena ecosystem: to be launched on the mainnet in Q1 next year; 15% of tokens are planned to be airdropped to ENA stakers

Original title: "Can Ethereal, the first airdrop project of Ethena ecosystem, replicate the miracle of Hyperliquid?"

Original author: Azuma, Odaily Planet Daily

Ethena (ENA) may be one of the most outstanding tokens in the past period of time.

Bitget market shows that since hitting the bottom at 0.194 USDT in early September, until yesterday's rebound to 1.33 USDT, ENA has achieved a nearly 600% increase in the past two months.

There are many answers to the reasons. For example, the contract funding rate rose in the bull market, driving Ethena's protocol revenue to rise sharply, and the supply of USDe also increased significantly; another example is the Trump family project World Liberty's support for ENA's purchase; and the expectation of the ENA fee switch being turned on by Wintermute; coupled with the direct cooperation with BlackRock BUIDL, a new stablecoin product USDtb was launched... In addition, the expectation of open airdrops for holding and staking ENA is also seen as a key reason for the continued rise of the token.

Previously, two major projects with a high degree of business relevance to USDe, Ethereal and Derive (formerly Lyra), have successively announced that they will airdrop to sENA holders (ie ENA staking users), of which Ethereal plans to airdrop 15% of the token supply and Derive plans to airdrop 5% of the token supply. Currently, users who hold sENA on the chain can directly view the "mining" status of these two projects on the Ethena homepage.

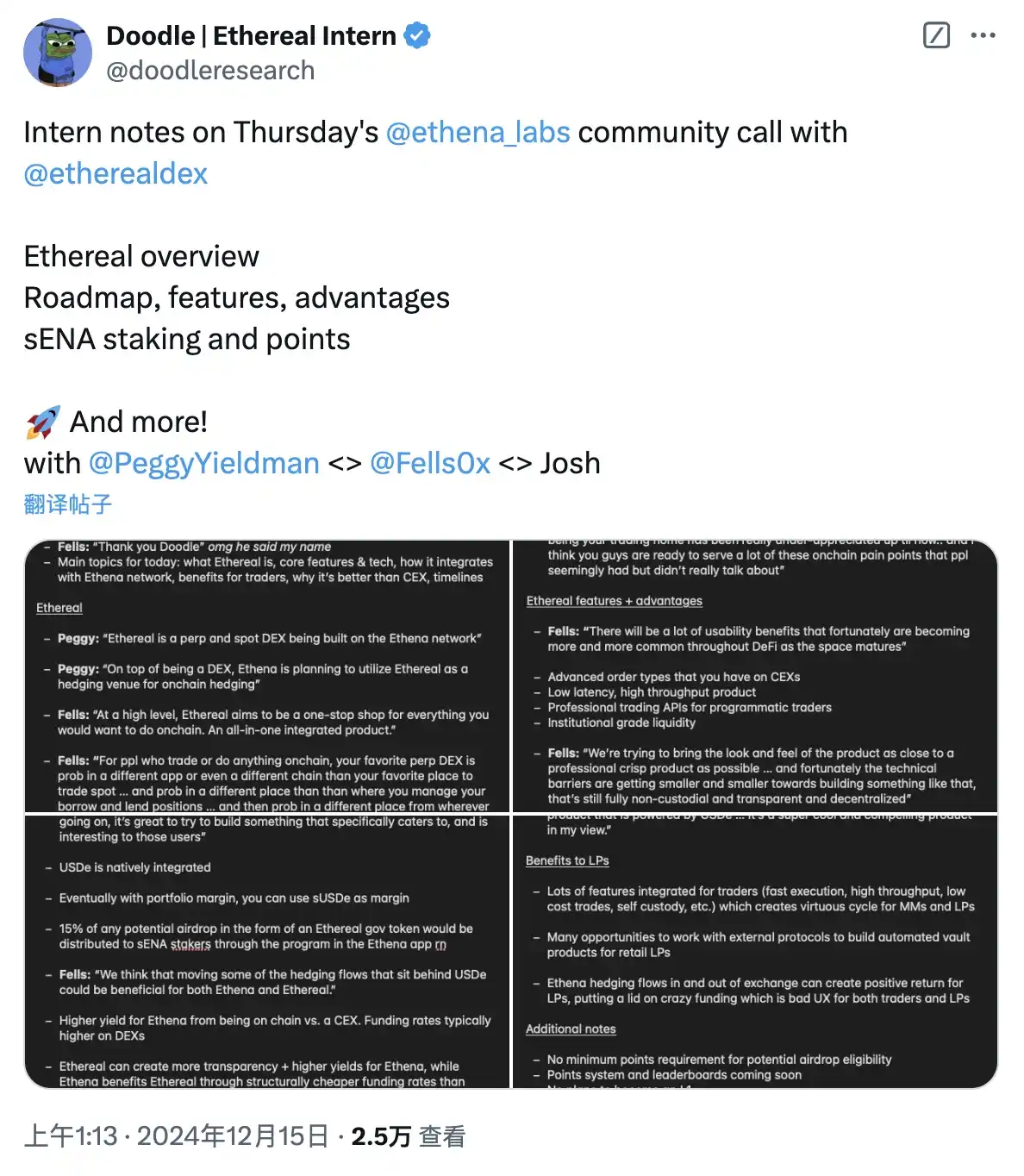

Last week, Ethereal officials held a community conference call, at which Ethereal's roadmap, functions, advantages and airdrops were outlined. It is worth mentioning that Ethereal's developers have obviously noticed the stunning performance of another strong project Hyperliquid in recent times, and mentioned that Ethereal hopes to build a "one-stop trading service" similar to Hyperliquid.

Ethereal: The first airdrop project of the Ethena ecosystem

Ethereal made its debut on September 30 this year.

At that time, Fells, the founder of Ethereal, initiated a related proposal on Ethena, proposing to build an on-chain trading venue around USDe that supports spot and derivative transactions. On the one hand, Ethena can profit from the expansion of USDe's utility, and on the other hand, Ethereal can seize the ecological hub position in advance in the early stage of USDe's growth.

From the perspective of architecture, Ethereal will serve as Layer 3 based on the Ethena network; from the perspective of business, in addition to being equipped with a complete trading system, Ethereal also supports the deployment of other USDe-related applications (such as lending).

In order to gain the support of the Ethena community and deepen the binding relationship, Ethereal stated in the initial version of the proposal that 15% of the tokens will be given as airdrops to ENA's pledge users.

Latest News: Learn from Hyperliquid

In the latest community conference call, Ethereal team members emphasized Hyperliquid and believed that the key factor for the project's success was "providing a complete set of trading services", solving the hidden pain point that users need to switch between different applications when performing different operations, which is more conducive to the retention of users and funds.

In this regard, Ethereal founder Fells also re-described Ethereal's positioning as "a one-stop product that supports all DeFi operations", where users can conduct spot or contract transactions, rate arbitrage, lending, options and even forecasting operations, and can use sUSDe (staking USDe) to obtain stable interest-bearing income.

Fells added that he hopes to make Ethereal a platform similar to CEX in terms of user experience, but at the same time Ethereal will remain completely non-custodial and decentralized. For example, Ethereal will abstract the payment of gas through a specific design, so users do not have to sign or pay gas fees for each transaction.

Timeline: Q1 mainnet launch

According to the timeline mentioned in the conference call, Ethereal expects the following development rhythm:

· Testnet release: expected next month;

· Test gateway shutdown;

· Mainnet launch: expected in the first quarter of 2025;

Falls also mentioned that Ethereal's concrete functions will be launched in stages, starting with USDe perpetual contract trading, followed by combined margin model, lending and spot trading. Related businesses are likely to be launched in the first half of 2025. In addition, Ethereal will only support the trading of a few blue-chip tokens at the beginning of its launch. After users and liquidity accumulate, a new batch of trading pairs will be launched every week.

Ethena's ecological expansion

Ethena's ecological landscape is expanding rapidly. In addition to Ethereal mentioned in this article, Derive, a derivative project formerly known as the options protocol Lyra, will also issue coins in the first quarter of next year, and will also airdrop 5% of tokens to sENA holders.

Benefiting from the positive sentiment of the bull market, the funding rate in the contract market continues to be high, driving up the yield of the Ethena protocol itself and sUSDe. As of the time of writing, the supply of USDe has approached the $6 billion mark, with a real-time yield of 27%.

At the same time, the new stablecoin product USDtb launched by Ethena and BlackRock BUIDL also made up for Ethena's biggest shortcoming - the protocol itself and sUSDe will temporarily show negative returns under the negative rate cycle. The structure of USDtb is similar to that of traditional RWA stablecoins. Its stability is supported by reserve assets, and its income comes from treasury bond interest rates. In the future, after the supply of this stablecoin increases, Ethena will obtain a reliable safe-haven window in the negative rate cycle or when the rate income is lower than the treasury bond income, thereby solving the hidden danger of the protocol being susceptible to negative rates.

Arthur Hayes, the well-known milk king and founder of BitMEX, predicted earlier this year that "USDe will surpass USDT to become the largest dollar stablecoin." Although the supply scale of the two parties is still dozens of times different, considering Ethena's current sustained high yield and ecological expansion speed, this is not impossible. If this expectation can be realized, ecological sub-projects such as Ethereal, which have seized the position of ecological hub in the early stage, will inevitably benefit, and then form value feedback to ENA again.

You may also like

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

Earn

Earn