Full text of the draft of "U.S. Strategic Bitcoin Reserve": Manage BTC as a permanent national asset

Original source: Bitcoin Policy Institute

Original translation: BitpushNews

On December 17, 2024, the Bitcoin Policy Institute drafted an executive order proposing to establish a strategic Bitcoin reserve under the Trump administration's U.S. Treasury Exchange Stabilization Fund (ESF), which needs to be signed after Trump takes office to take effect.

Bitpush Note: The Bitcoin Policy Institute is a nonpartisan, nonprofit organization dedicated to studying the policy and social impact of Bitcoin and emerging currency networks.

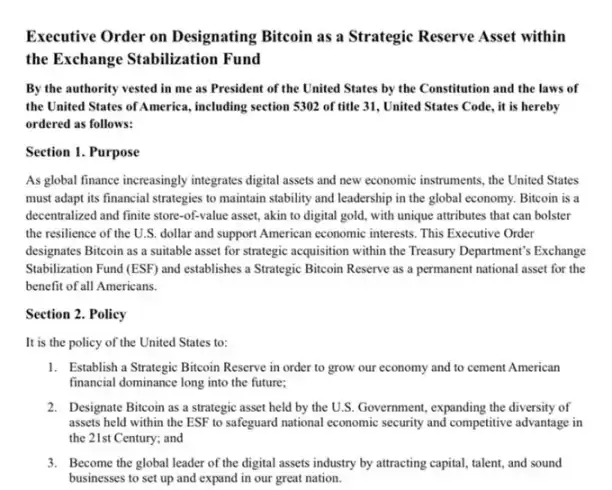

Below is the full text of the Executive Order:

By the authority vested in me by the Constitution and the laws of the United States, including 31 U.S.C. Section 5302, it is hereby ordered as follows:

Section 1. Purpose

As global finance increasingly integrates digital assets and new economic instruments, the United States must adapt its financial strategy to maintain global economic stability and leadership. Bitcoin is a decentralized, finite store of value asset, similar to digital gold, with unique properties that enhance the resiliency of the dollar and support U.S. economic interests.

This Executive Order designates Bitcoin as an asset suitable for strategic acquisition within the Treasury’s Exchange Stabilization Fund (ESF), establishes a strategic Bitcoin reserve, and maintains it as a permanent national asset for the benefit of all Americans.

Section 2. Policy

It is the policy of the United States:

1. Establish a Strategic Bitcoin Reserve to grow our economy and solidify America’s future financial dominance;

2. Designate Bitcoin as a strategic asset held by the U.S. Government, broaden the diversity of assets held by the ESF to protect national economic security and competitive advantage in the 21st century, and promote industry development by attracting capital, talent, and voices;

3. Become a global leader in the digital asset industry, building and expanding businesses across our great nation.

Section 3. Establishment of the SBR and Designation of Bitcoin as a Strategic Reserve Asset

(a) Establishment of a Strategic Bitcoin Reserve

The Strategic Bitcoin Reserve (SBR) is hereby established to be managed by the Secretary of the Treasury and to enhance the diversity of the United States’ reserve assets. To enhance confidence in its mission, the SBR will be subject to regular audits, rigorous security standards, and comprehensive reporting measures to ensure long-term accountability and security.

(b) Consolidation of Government Bitcoin Holding

Not later than 7 days after the date of this order, any bitcoin under the control of any Federal agency, including the United States Marshals Service, shall not be sold, exchanged, auctioned, or otherwise pledged and shall be transferred to the SBR by the head of such Federal agency upon acquisition of legal title to such bitcoin, including upon final, nonappealable judgment in a criminal or civil forfeiture action in favor of the Federal agency.

(c) Designation of Reserve Asset

Bitcoin is hereby designated as a strategic reserve asset suitable for purchase and holding within the ESF. Not later than 60 days after the date of this order, the Secretary of the Treasury is hereby directed to implement a Bitcoin Acquisition Program to acquire and manage Bitcoin within the ESF. The goal of the SBR is to position the United States as the undisputed world leader in Bitcoin holding, innovation, and management, ensuring that U.S. interests, rather than those of foreign competitors, set the standard for global digital asset strategy.

SECTION 4. ACQUISITION AND CUSTODY AGREEMENTS

(a) Acquisition Program

Pursuant to 31 U.S.C. 4 5302, which authorizes the Secretary of the Treasury to “deal with … credit instruments,” the Secretary of the Treasury is hereby directed to appropriate not less than $521 billion from the ESF for the strategic acquisition of Bitcoin for inclusion in the SBR, in a manner consistent with the Secretary’s obligations under law, by purchasing obligations from appropriate counterparties and repaying them in Bitcoin. The Secretary of the Treasury shall work with reputable market participants pursuant to agreements that maximize value and mitigate risk. The initial acquisition program shall be completed not later than 365 days after the date of this order.

(b) Custody and Security Protocols

In order to safeguard the SBR’s bitcoin holdings at all stages, the Secretary of the Treasury shall implement the following phased custody framework. Within 30 days of the date of this order, the Secretary shall confirm that the U.S. Government’s existing relationships with reputable and secure custody service providers are sufficient to ensure immediate, trusted storage solutions for bitcoin within the SBR. The Secretary shall direct that all bitcoin purchases under the acquisition program be securely transferred to such custody service providers.

In parallel, the Secretary shall coordinate with the National Security Agency, the Cybersecurity and Infrastructure Security Agency, the National Institute of Standards and Technology (NIST), and any other agencies requested by the Secretary to develop and implement self-custody protocols (including dedicated hardware, assured software, access controls, geographic distribution, multi-signature controls, and physical security measures) designed to enhance long-term security, reduce reliance on third parties, and maintain full sovereign control over the United States’ bitcoin reserves as a “digital Fort Knox.” The Secretary should ensure that the SBR custody agreement is consistent with ESF audit procedures, rigorous cybersecurity standards, and cryptographic proof of reserve verification to safeguard the integrity of the SBR and the confidence of the American public.

Section 5. Conditions for Sale of the Strategic Bitcoin Reserve

(a) Long-Term Preservation

The SBR should serve as a permanent pillar of America’s financial strength and commitment to the future of the digital economy, in the same enduring spirit that preserved our nation’s gold reserve at Fort North. Bitcoin held in the SBR should not be viewed as a short-term financial instrument or a rainy day fund for day-to-day emergencies, but rather as a generational asset that supports America’s prosperity and security for decades to come. It is the policy of the United States. The Government shall hold (HODL) all Bitcoin acquired in the SBR for at least 25 years after the date of this order.

(b) Strict Limitations on Liquidation

Sales or other divestments of the SBR should be permitted only in the most dire and extraordinary circumstances, which clearly outweigh ordinary financial volatility or geopolitical uncertainty.

(c) Rigorous Approval Process

Before any sale is made, the Secretary of the Treasury shall submit a detailed written decision, accompanied by substantial evidence, demonstrating that the proposed liquidation is in direct response to an extraordinary national economic or security crisis. The decision must be approved by the President of the United States. The Secretary of the Treasury shall not be authorized to sell, pledge, exchange, or otherwise dispose of any portion of the SBR without express authorization.

(d) Transparent and Controlled Execution

In the rare circumstances in which a sale is approved, it should be conducted through the most sensible and tightly controlled methods to minimize market impact and maintain public confidence. Preference should be given to private, staged transactions or other measured methods that ensure that, even in a crisis, the nation's reputation for financial prudence and responsibility remains intact.

Section 6. Reporting and Transparency

(a) Public Reserve Certification

The Secretary of the Treasury shall implement a public reserve certification process using cryptographic certifications. These certifications shall be provided on a quarterly basis to ensure transparency of the ESF’s bitcoin holdings while protecting sensitive security information.

(b) Annual Report

As part of the annual report on the operations of the ESF required by the Gold Reserve Act, the Secretary of the Treasury shall provide detailed information on the status, performance, and strategic advantages of bitcoin within the ESF. The report shall also summarize acquisition strategies, custodial security measures, and impacts on economic stability, subject to considerations of national economic security.

Section 7. Interagency Coordination

The Secretary of the Treasury shall coordinate with the Federal Reserve, the Department of Defense, and other relevant Federal agencies to ensure that the acquisition and management of bitcoin within the ESF is consistent with United States national security, economic stability, and cybersecurity standards.

You may also like

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

Earn

Earn