Grayscale 2025 Q1 Top Picks: 20 Tokens with High Growth Potential

Original Title: Grayscale Research Insights: Crypto Sectors in Q1 2025

Original Source: Grayscale Research

Original Translation: Golem, Odaily Planet Daily

Summary:

· The crypto market saw a significant surge in Q4 2024, with the FTSE/Grayscale Crypto Sectors Index demonstrating strong market performance. The rally largely reflected the market's positive response to the outcome of the U.S. presidential election.

· Competition in the smart contract platform sector remains intense. The price performance of sector leader Ethereum has lagged behind its second-largest competitor Solana, and investors are increasingly focusing on other Layer 1 networks such as Sui and The Open Network (TON).

· Grayscale Research updated the Top 20 token list, representing diversified assets in the cryptocurrency industry that may have high potential in the next quarter. New assets added in Q1 2025 include HYPE, ENA, VIRTUAL, JUP, JTO, and GRASS. All assets in the Top 20 list exhibit high price volatility and should be considered high-risk.

Grayscale Crypto Sectors Index

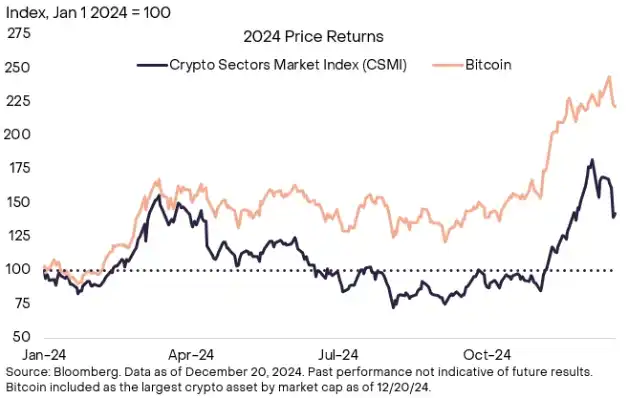

The Grayscale Crypto Sectors provide a comprehensive framework for understanding the range of investable digital assets and their relationship to underlying technologies. Building on this framework and in collaboration with FTSE Russell, Grayscale has developed the FTSE Grayscale Crypto Sectors Index series to measure and monitor crypto assets (Figure 1). Grayscale Research incorporates this index into its analysis of the digital asset market.

Figure 1: Positive Returns of the 2024 Grayscale Crypto Sectors Index

Cryptocurrency valuations soared in the fourth quarter of 2024, primarily due to the market's positive reaction to the U.S. election results. According to the Crypto Sector Market Index (CSMI), the industry's total market cap increased from $1 trillion to $3 trillion in this quarter. Figure 2 compares the total cryptocurrency market cap to various traditional public and private market asset categories. For instance, the current market value of the digital asset industry is roughly equivalent to the global inflation-linked bond market – more than double the U.S. high-yield bond market, yet still significantly below the global hedge fund industry or the Japanese stock market.

Figure 2: Cryptocurrency Market Cap Increases by $1 Trillion in Q4 2024

Due to the valuation increase, many new tokens met the inclusion criteria of Grayscale's Crypto Sectors framework (which sets a minimum market cap requirement of $1 billion for most tokens). In this quarter's rebalance, Grayscale added 63 new assets to the index series, now totaling 283 tokens. The consumer and culture sectors saw the most new token additions, reflecting the ongoing strong performance of meme coins and the appreciation of various assets related to gaming and social media.

By market cap, the largest new asset in Crypto Sectors is Mantle, an Ethereum Layer 2 protocol, which now meets the minimum liquidity requirement (for more detailed information on Grayscale index inclusion criteria, please refer to here).

Smart Contract Platform Competition

The smart contract platform space may be the most fiercely competitive submarket in the digital asset industry. While 2024 was a milestone year for the leader in this space, Ethereum—receiving approval for a U.S. exchange-traded product (ETP) and undergoing significant upgrades—ETH's performance lags behind some competitors like Solana, the second-largest asset by market cap in the space. Investors are also turning their attention to other L1 networks, including high-performance blockchains like Sui and the blockchain TON integrated with the Telegram platform.

When building infrastructure for application developers, architects of smart contract blockchains face a variety of design choices. These design choices impact the three factors that make up the "blockchain trilemma": network scalability, network security, and network decentralization. For example, prioritizing scalability often manifests as high transaction throughput and low fees (e.g., Solana), while prioritizing decentralization and network security may result in lower throughput and higher fees (e.g., Ethereum). These design choices lead to different block times, transaction throughputs, and average transaction fees (Figure 3).

Figure 3: Smart Contract Platforms Have Different Technical Features

Regardless of design choices and network trade-offs, smart contract platforms derive their value through network fee revenue. While other metrics such as total TVL are also crucial, fee revenue can be seen as a primary driver of token value accumulation in this market segment (related reading: The Value War in Smart Contract Platforms).

As shown in Figure 4, there is a statistical relationship between smart contract platform fee revenue and market capitalization. The stronger the network's ability to generate fee revenue, the greater its ability to pass value to the network in the form of token burning or staking rewards. This quarter, the Top 20 token list listed by Grayscale Research includes some smart contract platform tokens: ETH, SOL, SUI, and OP.

Figure 4: All smart contract platforms are competing for fee revenue

Grayscale Research Top 20 Token List

Each quarter, the Grayscale Research team analyzes hundreds of digital assets to provide insights for the rebalancing process of the FTSE/Grayscale Crypto Sectors index series. Following this process, Grayscale Research generates a list of the top 20 assets within the Crypto Sectors domain. The top 20 represent diversified assets across Crypto Sectors and these assets may have high potential in the upcoming quarter (Figure 4). The selection of this list combines a range of factors, including network growth/adoption, upcoming catalysts, sustainability of fundamentals, token valuation, token supply inflation, and potential tail risks.

In Q1 2025, Grayscale will focus on tokens that are involved in at least one of the following three core market themes:

· The U.S. election and its potential impact on industry regulation, especially in decentralized finance (DeFi) and staking;

· Continued breakthroughs in decentralized AI technology and the use of AI agents in blockchain;

· Growth of the Solana ecosystem.

Based on these themes, the following six assets have been added to the Top 20 list for the first quarter of 2025:

1. Hyperliquid (HYPE): Hyperliquid is an L1 blockchain designed to support on-chain financial applications. Its primary application is a decentralized exchange (DEX) for perpetual futures with a fully on-chain order book.

2. Ethena (ENA): The Ethena protocol has evolved into the new stablecoin USDe, primarily collateralized by Bitcoin and Ethereum hedge positions. Specifically, the protocol holds long positions in Bitcoin and Ether as well as short positions in perpetual futures contracts of the same assets. The staked version of this token provides yield through the price differential between spot and futures.

3. Virtual Protocol (VIRTUAL): Virtual Protocol is a platform built on the Ethereum L2 network Base to create AI agents. These AI agents are designed to mimic human decision-making and autonomously perform tasks. The platform allows for the creation and co-ownership of tokenized AI agents that can interact with their environment and other users.

4. Jupiter (JUP): Jupiter is a top-tier DEX aggregator on Solana with the highest TVL in the network. With retail traders increasingly entering the cryptocurrency market through Solana and speculative activities surrounding Solana-based memecoins and AI agent tokens on the rise, we believe Jupiter is well-positioned to capitalize on this growing market.

5. Jito (JTO): Jito is a liquidity protocol on Solana. Jito has seen significant adoption over the past year and boasts the best financials in the cryptocurrency space, with fee revenue surpassing $5.5 billion in 2024.

6. Grass (GRASS): Grass is a decentralized data network that rewards users for sharing their unused internet bandwidth through a Chrome extension. This bandwidth is used to scrape online data, which is then sold to AI companies and developers for training machine learning models, effectively enabling web data scraping while compensating users.

Figure 5: Top 20 Additions including DeFi Applications, AI Agents, and the Solana Ecosystem

Note: Shadow denotes new tokens coming in the upcoming quarter (Q1 2025). "*" denotes sector-related assets not included in the Crypto Sectors index. Data Source: Artemis, Grayscale Investments. Data as of December 20, 2024, for reference only. Assets are subject to change. Grayscale and its affiliates and clients may hold positions in the digital assets discussed in this document. All Top 20 assets are highly price volatile and should be considered high-risk assets.

In addition to the new themes mentioned above, Grayscale remains bullish on themes from the past few quarters, such as Ethereum scaling solutions, tokenization, and Decentralized Physical Infrastructure (DePIN). These themes are still reflected through protocols re-entering the Top 20, such as Optimism, Chainlink, and Helium.

This quarter, we have removed Celo from the Top 20. Grayscale Research continues to be optimistic about these projects and believes they remain integral to the crypto ecosystem. However, the revised Top 20 list may offer a more compelling risk-reward profile in the next quarter.

Investing in crypto assets carries risks, some of which are unique to the asset class, including smart contract vulnerabilities and regulatory uncertainty. Furthermore, all assets in the Top 20 exhibit high volatility and should be considered high-risk, making them unsuitable for all investors. Given the risks of the asset class, any investment in digital assets should be considered in the context of a portfolio and with respect to an investor's financial goals.

You may also like

Giannis Antetokounmpo's Investment in Kalshi Sparks Outrage: Idol Crossover or Insider Trading Scheme?

Mr. Beast Acquires Step: Top Streamer Enters Teen Finance Race?

Not Just Guessing Right or Wrong, Market Prediction Is Getting More and More “Fun”

$55,000 will be Bitcoin's make-or-break level

February 10th Key Market Information Gap, A Must-See! | Alpha Morning Report

About ERC-8004: Everything You Need to Know

ai.com's Debut Flop: After $70 Million Transaction, Did It Get a '504' Timeout?

FedNow versus The Clearing House: Who Will Win the Fed Payments Fray?

Recovering $70,000 in Lost Funds: The "Fragile Logic" Behind Bitcoin's Rebound

Mr. Beast acquires Step, Farcaster Founder Joins Tempo, what are the international crypto circles talking about today?

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…